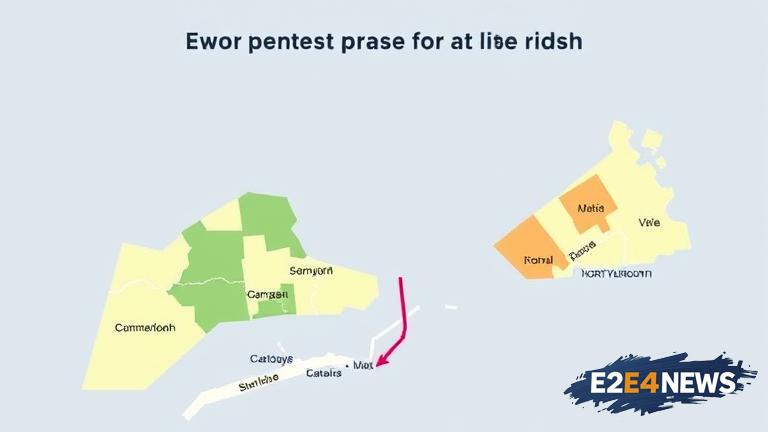

Property revaluations are ramping up in Cumberland and North Yarmouth, with local officials working to ensure that property assessments are fair and accurate. The revaluation process is a routine part of property tax administration, aimed at updating property values to reflect current market conditions. In Cumberland, the town is in the midst of a comprehensive revaluation, with a team of assessors and appraisers working to review and update property values. The process involves a thorough analysis of market data, including recent sales and other relevant factors. The goal is to ensure that property assessments are fair and equitable, with all properties being assessed at their full and fair market value. In North Yarmouth, the town is also undergoing a revaluation, with a focus on ensuring that property assessments are accurate and up-to-date. The revaluation process is expected to take several months to complete, with property owners being notified of any changes to their assessments. The revaluation process is an important part of maintaining a fair and equitable property tax system, as it helps to ensure that property owners are paying their fair share of taxes. By updating property values to reflect current market conditions, the revaluation process helps to prevent inequities and disparities in the tax system. In addition to ensuring fair and accurate property assessments, the revaluation process also provides an opportunity for property owners to review and appeal their assessments if they disagree with them. The revaluation process is typically done on a periodic basis, such as every 5-10 years, depending on the town’s needs and resources. In Cumberland and North Yarmouth, the revaluation process is being done in response to changes in the local real estate market, including increases in property values and shifts in market trends. The revaluation process involves a team of professionals, including assessors, appraisers, and data analysts, who work together to review and update property values. The team uses a variety of tools and techniques, including data analysis and on-site inspections, to determine the value of each property. The revaluation process is a complex and time-consuming one, requiring careful attention to detail and a thorough understanding of the local real estate market. Despite the challenges, the revaluation process is an important part of maintaining a fair and equitable property tax system, and local officials are working hard to ensure that it is done accurately and efficiently. Property owners in Cumberland and North Yarmouth can expect to receive notification of any changes to their assessments, and will have the opportunity to review and appeal their assessments if they disagree with them. The revaluation process is expected to be completed by the end of the year, with the new assessments taking effect for the upcoming tax year. In the meantime, property owners can contact their local assessor’s office for more information about the revaluation process and how it may affect their property. The revaluation process is an important part of local government, and local officials are committed to ensuring that it is done in a fair and transparent manner. By updating property values to reflect current market conditions, the revaluation process helps to ensure that property owners are paying their fair share of taxes, and that the local tax system is fair and equitable. The revaluation process is a routine part of property tax administration, but it is an important one, and local officials are working hard to ensure that it is done accurately and efficiently. Overall, the property revaluations in Cumberland and North Yarmouth are an important step towards ensuring that the local property tax system is fair and equitable, and that property owners are paying their fair share of taxes.