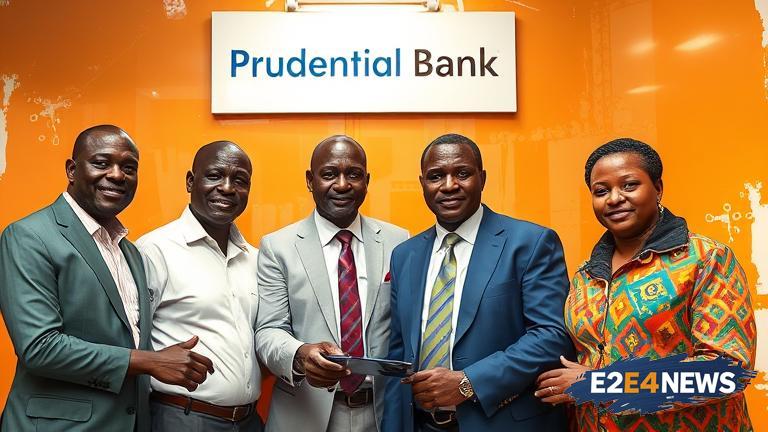

Prudential Bank, a leading financial institution in Ghana, has announced its commitment to supporting the Ghana Entrepreneurship and Technology Innovation Community (GTEC). This partnership is expected to empower Ghanaian entrepreneurs and startups, providing them with the necessary resources and expertise to succeed. The bank’s pledge is a significant boost to the country’s entrepreneurship ecosystem, which has been growing rapidly in recent years. GTEC is a community that brings together entrepreneurs, innovators, and industry experts to share knowledge, ideas, and experiences. By supporting GTEC, Prudential Bank is demonstrating its dedication to promoting economic growth and development in Ghana. The bank’s support will enable GTEC to organize workshops, training sessions, and other events that will help entrepreneurs develop their skills and build successful businesses. Prudential Bank’s commitment to GTEC is also expected to create jobs and stimulate economic activity in the country. The bank’s management has expressed its enthusiasm for the partnership, stating that it is an opportunity to contribute to the growth and development of Ghana’s economy. The partnership is also expected to enhance the bank’s reputation as a supporter of entrepreneurship and innovation in Ghana. GTEC has welcomed Prudential Bank’s pledge, stating that it will help to take the community to the next level. The community’s leaders have expressed their gratitude to the bank for its support, which they believe will have a positive impact on the country’s entrepreneurship ecosystem. The partnership between Prudential Bank and GTEC is a significant development for Ghana’s entrepreneurship sector, which has been identified as a key driver of economic growth. The country’s government has been implementing policies and programs to support entrepreneurship, and the partnership between Prudential Bank and GTEC is a testament to the private sector’s commitment to this goal. Prudential Bank’s support for GTEC is also expected to encourage other financial institutions to follow suit, which could lead to a surge in support for entrepreneurship and innovation in Ghana. The bank’s pledge is a demonstration of its confidence in the potential of Ghanaian entrepreneurs and startups to drive economic growth and development. The partnership is also expected to facilitate the exchange of ideas and expertise between Prudential Bank and GTEC, which could lead to the development of new financial products and services that cater to the needs of entrepreneurs and startups. Furthermore, the partnership is expected to enhance the bank’s understanding of the needs of entrepreneurs and startups, which could lead to the development of more effective financial solutions. In addition, the partnership is expected to provide opportunities for Prudential Bank to engage with the entrepreneurship community, which could lead to the identification of new business opportunities. The bank’s support for GTEC is also expected to contribute to the development of a more vibrant and dynamic entrepreneurship ecosystem in Ghana, which could attract foreign investment and talent. Overall, the partnership between Prudential Bank and GTEC is a positive development for Ghana’s entrepreneurship sector, and it is expected to have a significant impact on the country’s economic growth and development. The partnership is a testament to the power of collaboration between the private sector and entrepreneurship communities, and it is expected to serve as a model for other financial institutions and entrepreneurship communities in Ghana. The bank’s pledge is a demonstration of its commitment to supporting the growth and development of Ghana’s economy, and it is expected to contribute to the country’s economic prosperity. The partnership is also expected to enhance the bank’s reputation as a responsible and supportive financial institution, which could lead to an increase in customer loyalty and retention.