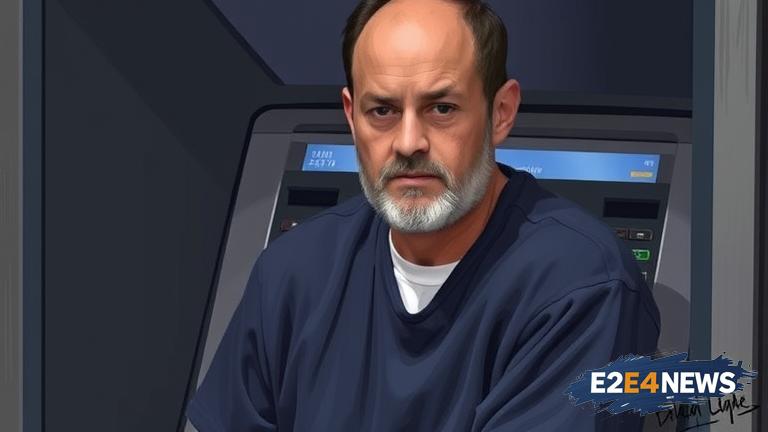

A former Hollywood resident, whose name has not been released, has been sentenced to 10 years in prison for his involvement in a card skimming scheme that targeted ATMs across California. The scheme, which involved the installation of skimming devices on ATMs, allowed the perpetrator to steal sensitive financial information from unsuspecting victims. The devices, which were cleverly designed to blend in with the ATMs, captured card numbers, expiration dates, and security codes, giving the perpetrator access to the victims’ bank accounts. The perpetrator then used this information to make unauthorized withdrawals and purchases, resulting in significant financial losses for the victims. The investigation into the scheme was led by the Los Angeles Police Department, with assistance from the FBI and other law enforcement agencies. The perpetrator was arrested in 2022, after a lengthy investigation that involved the analysis of surveillance footage and financial records. The case highlights the growing threat of card skimming and the importance of vigilance when using ATMs. Card skimming is a type of financial fraud that involves the theft of sensitive financial information, often through the use of skimming devices installed on ATMs or point-of-sale terminals. The devices are typically installed by criminals who then use the stolen information to make unauthorized transactions. The scheme is often difficult to detect, as the devices are designed to be discreet and may not be noticeable to the average user. However, there are steps that individuals can take to protect themselves from card skimming, including monitoring their accounts regularly and reporting any suspicious activity to their bank. Additionally, individuals can take steps to avoid using ATMs that appear to have been tampered with, such as looking for signs of tampering or checking for any unusual attachments. The sentence handed down in this case reflects the seriousness with which law enforcement agencies and the courts view card skimming and other forms of financial fraud. The perpetrator’s actions resulted in significant financial losses for the victims, and the sentence is intended to serve as a deterrent to others who may be considering engaging in similar activities. The case also highlights the importance of cooperation between law enforcement agencies and financial institutions in combating financial fraud. By working together, these entities can share information and resources to identify and prosecute those responsible for card skimming and other forms of financial fraud. The sentence is also a reminder that card skimming is a serious crime that can have significant consequences for those who engage in it. The perpetrator in this case will spend the next 10 years in prison, reflecting on the consequences of his actions. The case serves as a warning to others who may be considering engaging in similar activities, and highlights the importance of protecting oneself from financial fraud. Individuals can take steps to protect themselves, such as monitoring their accounts regularly and being cautious when using ATMs. By taking these steps, individuals can reduce their risk of becoming a victim of card skimming and other forms of financial fraud. The investigation into the scheme is ongoing, and law enforcement agencies are encouraging anyone with information to come forward. The case is a reminder that financial fraud can have serious consequences, and that law enforcement agencies are committed to combating it. The perpetrator’s sentence is a reflection of the seriousness with which the courts view card skimming, and serves as a deterrent to others who may be considering engaging in similar activities. The case highlights the importance of vigilance and cooperation in combating financial fraud, and serves as a reminder to individuals to take steps to protect themselves from card skimming and other forms of financial fraud.