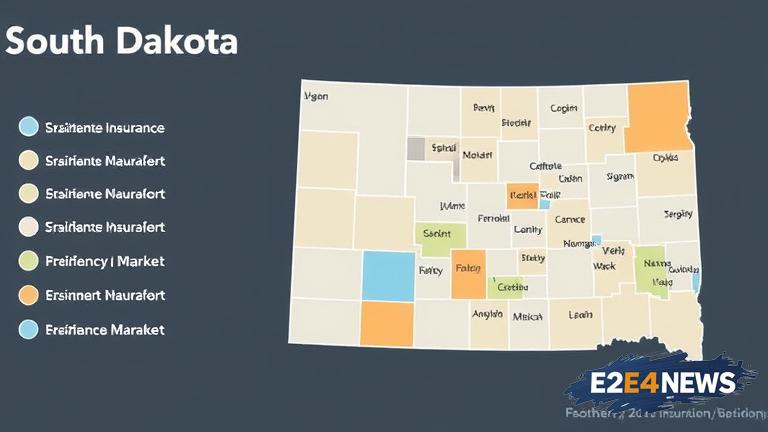

The insurance market in South Dakota is regulated by the South Dakota Division of Insurance, which oversees the industry to ensure compliance with state laws and regulations. The division is responsible for licensing insurance companies, agents, and brokers, as well as investigating consumer complaints. South Dakota requires insurance companies to file their rates and policy forms with the division for approval. The state has a relatively low cost of living, which can impact insurance rates. Auto insurance is mandatory in South Dakota, with drivers required to carry liability insurance and uninsured motorist coverage. Homeowners insurance is also popular, with many residents opting for policies that cover damage from natural disasters such as tornadoes and hail storms. Health insurance is another important type of coverage, with many residents relying on employer-sponsored plans or individual policies. The Affordable Care Act has had a significant impact on the health insurance market in South Dakota, with many residents eligible for subsidies or Medicaid expansion. Life insurance is also widely available, with many companies offering term life, whole life, and universal life policies. South Dakota has a relatively low rate of uninsured drivers, with about 7.4% of drivers lacking coverage. The state also has a low rate of complaints filed against insurance companies, with many residents reporting positive experiences with their insurers. However, some residents have reported difficulties in finding affordable coverage, particularly in rural areas. The South Dakota insurance market is served by a range of national and regional insurance companies, including State Farm, Allstate, and Farmers Insurance. The state is also home to several local insurance agencies and brokerages, which can provide personalized service and guidance to residents. In recent years, the South Dakota insurance market has been impacted by changes in the weather, with severe storms and natural disasters driving up claims and premiums. Despite these challenges, the insurance market in South Dakota remains competitive, with many companies offering a range of products and services to meet the needs of residents. Overall, the South Dakota insurance market is characterized by a strong regulatory framework, a range of insurance options, and a relatively low cost of living.