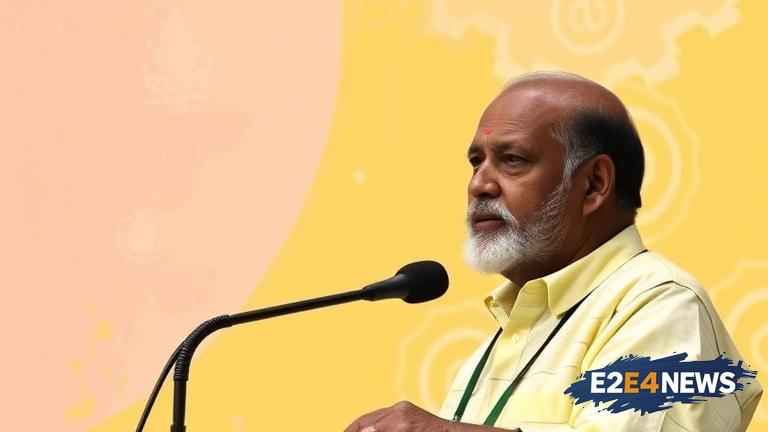

The Kerala Finance Minister has voiced concerns over the ongoing GST reforms, emphasizing the need to protect state revenue to avoid adverse effects on welfare schemes. The Minister’s statement comes amidst discussions on the GST framework, which has been a subject of debate among state governments and the central government. The GST Council, responsible for overseeing the GST framework, has been working towards implementing reforms to simplify the tax structure and increase revenue. However, the Kerala Finance Minister has cautioned that these reforms must not compromise state revenue, which is crucial for funding welfare schemes. The Minister argued that any reduction in state revenue would directly impact the implementation of welfare schemes, which are essential for the socio-economic development of the state. Kerala has been at the forefront of implementing welfare schemes, and any cuts to these programs would have far-reaching consequences. The state government has been working towards increasing revenue through various means, including improving tax compliance and exploring new revenue streams. However, the GST reforms pose a significant challenge to these efforts, and the Minister has urged the central government to take into account the concerns of state governments. The GST Council has been considering various proposals to reform the GST framework, including the introduction of a single tax rate and the simplification of tax slabs. While these reforms aim to simplify the tax structure and increase revenue, they also pose a risk to state revenue, which is a major concern for the Kerala Finance Minister. The Minister has emphasized the need for a balanced approach to GST reforms, one that takes into account the concerns of both state governments and the central government. The Kerala government has been working closely with the GST Council to ensure that the reforms do not adversely affect state revenue. The state government has also been exploring alternative revenue streams, including increasing tax compliance and improving tax administration. Despite these efforts, the Kerala Finance Minister has warned that any reduction in state revenue would have significant consequences for welfare schemes. The Minister has urged the central government to consider the long-term implications of GST reforms on state revenue and welfare schemes. The GST reforms have been a subject of debate among state governments, with some states expressing concerns over the potential impact on their revenue. The Kerala Finance Minister’s statement highlights the need for a careful and balanced approach to GST reforms, one that takes into account the concerns of all stakeholders. The Minister has emphasized the importance of protecting state revenue to ensure the continued implementation of welfare schemes, which are essential for the socio-economic development of the state. The Kerala government has been committed to implementing welfare schemes, and any cuts to these programs would have far-reaching consequences. The GST reforms pose a significant challenge to these efforts, and the Minister has urged the central government to work closely with state governments to ensure that the reforms do not adversely affect state revenue. The Kerala Finance Minister’s statement has highlighted the need for a coordinated approach to GST reforms, one that takes into account the concerns of all stakeholders. The Minister has emphasized the importance of protecting state revenue to ensure the continued implementation of welfare schemes, which are essential for the socio-economic development of the state. The GST reforms have been a subject of debate among state governments, and the Kerala Finance Minister’s statement has added to the discussion. The Minister has urged the central government to consider the long-term implications of GST reforms on state revenue and welfare schemes, and to work closely with state governments to ensure that the reforms do not adversely affect state revenue.