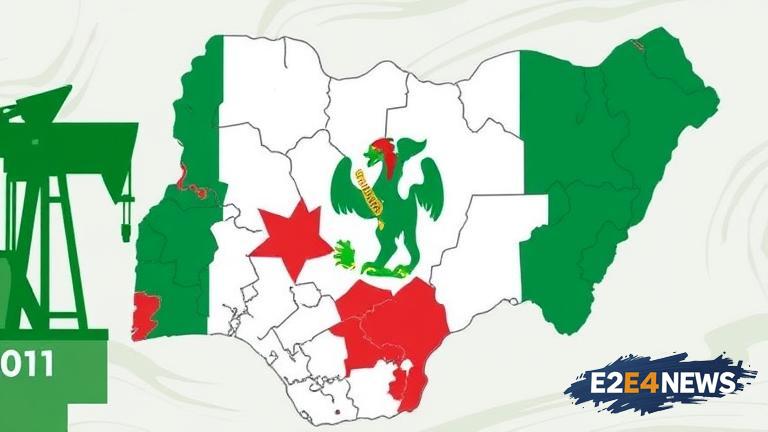

The oil-producing states in Nigeria have received a substantial debt relief of N611 billion from the 13% derivation fund. This fund is a percentage of the revenue generated from oil production in these states, which is allocated to them to support their development and growth. The debt relief is expected to have a positive impact on the economy of these states, as it will enable them to allocate more resources to critical sectors such as infrastructure, education, and healthcare. The 13% derivation fund is a constitutional provision that ensures oil-producing states receive a fair share of the revenue generated from oil production. Over the years, the fund has played a crucial role in supporting the development of these states, which have historically been the backbone of Nigeria’s economy. The debt relief is a welcome development, as it will help to reduce the financial burden on these states and enable them to focus on delivering critical services to their citizens. The oil-producing states have been facing significant financial challenges in recent years, due to the decline in oil prices and the impact of the COVID-19 pandemic. The debt relief will provide a much-needed boost to their economies, and enable them to invest in critical infrastructure such as roads, bridges, and hospitals. The 13% derivation fund has been a subject of controversy over the years, with some states arguing that they are not receiving their fair share of the revenue. However, the debt relief is a clear indication that the fund is being utilized to support the development of oil-producing states. The Nigerian government has been working to increase the transparency and accountability of the 13% derivation fund, to ensure that the revenue is being utilized effectively. The debt relief is a significant achievement, and it demonstrates the government’s commitment to supporting the development of oil-producing states. The oil-producing states are expected to use the debt relief to invest in critical sectors, and to improve the living standards of their citizens. The debt relief is also expected to have a positive impact on the overall economy of Nigeria, as it will help to stimulate economic growth and development. The 13% derivation fund is an important mechanism for supporting the development of oil-producing states, and it is essential that it is utilized effectively to achieve its objectives. The Nigerian government must continue to work to increase the transparency and accountability of the fund, to ensure that the revenue is being utilized to benefit the citizens of oil-producing states. The debt relief is a significant development, and it is expected to have a positive impact on the economy of Nigeria. The oil-producing states must use the debt relief to invest in critical sectors, and to improve the living standards of their citizens. The Nigerian government must also continue to work to address the challenges facing oil-producing states, including the decline in oil prices and the impact of the COVID-19 pandemic. The 13% derivation fund is a critical mechanism for supporting the development of oil-producing states, and it is essential that it is utilized effectively to achieve its objectives. The debt relief is a welcome development, and it is expected to have a positive impact on the economy of Nigeria. The oil-producing states are expected to use the debt relief to invest in critical infrastructure, and to improve the living standards of their citizens. The Nigerian government must continue to work to increase the transparency and accountability of the 13% derivation fund, to ensure that the revenue is being utilized effectively. The debt relief is a significant achievement, and it demonstrates the government’s commitment to supporting the development of oil-producing states. The oil-producing states must use the debt relief to invest in critical sectors, and to improve the living standards of their citizens. The Nigerian government must also continue to work to address the challenges facing oil-producing states, including the decline in oil prices and the impact of the COVID-19 pandemic.