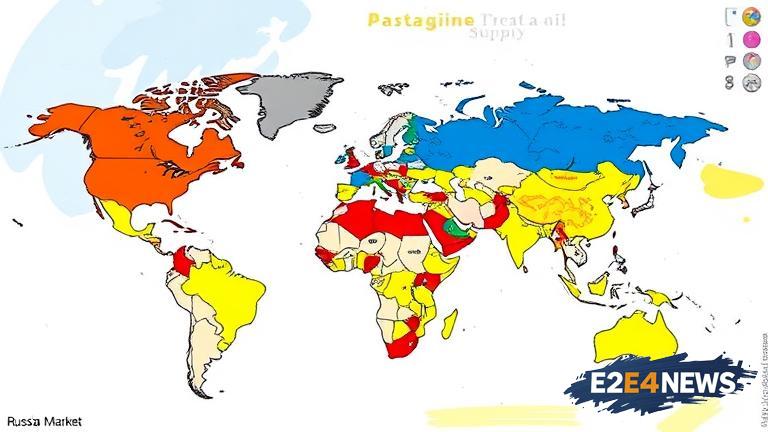

The global oil market has experienced significant fluctuations in recent days, with prices easing after reaching a 2-week high. This surge in prices was largely attributed to concerns over supply disruptions stemming from the ongoing conflict between Russia and Ukraine. As the situation continues to unfold, investors and analysts are closely monitoring the impact on the global energy landscape. The conflict has raised fears of potential supply chain disruptions, particularly in regards to Russian oil exports. Russia is one of the world’s largest oil producers, and any disruption to its exports could have far-reaching consequences for the global market. The price of Brent crude, the international benchmark, had risen to its highest level in two weeks, before easing as the market began to factor in the potential risks. The US West Texas Intermediate (WTI) crude also saw a similar trend, with prices fluctuating in response to the geopolitical tensions. The supply concerns have been exacerbated by the fact that Russia is a key player in the global oil market, and any disruption to its exports could lead to a shortage of supply. This, in turn, could drive up prices and have a negative impact on the global economy. The conflict has also raised concerns about the potential for a wider conflict, which could have even more severe consequences for the global oil market. As the situation continues to evolve, investors and analysts are closely watching the developments and assessing the potential risks and opportunities. The oil market is highly sensitive to geopolitical events, and the current situation is no exception. The price volatility is likely to continue in the coming days and weeks, as the market reacts to the latest developments. The Organization of the Petroleum Exporting Countries (OPEC) has also been monitoring the situation closely, and is ready to take action if necessary to stabilize the market. The global oil market is complex and influenced by a variety of factors, including geopolitical events, supply and demand, and economic trends. The current situation is a reminder of the importance of diversifying energy sources and reducing dependence on any one particular region or country. The US, in particular, has been working to reduce its dependence on foreign oil, and has made significant strides in recent years. However, the current situation highlights the ongoing challenges and complexities of the global energy landscape. The European Union has also been impacted by the conflict, with several member states relying heavily on Russian oil imports. The EU has been working to reduce its dependence on Russian energy, but the current situation has highlighted the ongoing challenges. The conflict has also raised concerns about the potential for a wider conflict, which could have even more severe consequences for the global oil market. As the situation continues to unfold, investors and analysts are closely monitoring the developments and assessing the potential risks and opportunities. The oil market is likely to remain volatile in the coming days and weeks, as the market reacts to the latest developments. The global economy is also likely to be impacted, particularly if the conflict leads to a prolonged disruption to oil supplies. The situation is a reminder of the importance of energy security and the need for diversification of energy sources. The current situation is complex and multifaceted, and is likely to have far-reaching consequences for the global oil market and the wider economy.