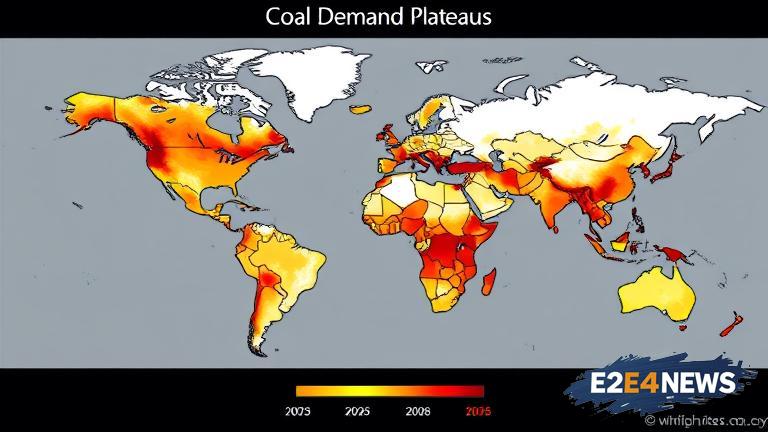

The global coal demand is projected to remain on a plateau in 2025 and 2026, according to recent market trends and analysis. This stabilization is attributed to the growing competition from renewable energy sources, such as solar and wind power, which are becoming increasingly cost-competitive with coal. Additionally, the decline in coal prices has made it less attractive to investors, leading to a decrease in new coal mine developments and expansions. The COVID-19 pandemic has also had a lasting impact on the global energy market, with many countries shifting their focus towards cleaner and more sustainable energy sources. As a result, the demand for coal is expected to remain stagnant, with some regions even experiencing a decline in coal consumption. The Asian market, which has historically been a major driver of coal demand, is expected to see a slowdown in growth due to increasing environmental concerns and government policies aimed at reducing carbon emissions. In contrast, some countries in Europe and North America are expected to see a slight increase in coal demand, driven by the need for reliable and baseload power generation. However, this increase is expected to be short-lived, as these countries also transition towards cleaner energy sources. The coal industry is also facing challenges from rising production costs, particularly in countries with high labor and transportation costs. Furthermore, the increasing use of natural gas and other alternative energy sources is expected to continue to erode coal’s market share. Despite these challenges, some countries, such as China and India, are expected to continue to drive coal demand, driven by their rapid industrialization and urbanization. However, even in these countries, the growth in coal demand is expected to slow down due to government policies aimed at reducing air pollution and carbon emissions. The global coal market is also expected to be impacted by trade tensions and geopolitical uncertainties, which could disrupt coal supply chains and impact prices. In response to these challenges, the coal industry is expected to undergo significant changes, including consolidation, diversification, and investment in new technologies. Some coal companies are already exploring new business models, such as producing coal for non-energy uses, such as steel production and chemicals. Others are investing in renewable energy sources, such as wind and solar power, to diversify their portfolios and reduce their dependence on coal. Overall, the global coal market is expected to remain challenging in 2025 and 2026, with demand plateauing and competition from renewable energy sources increasing. As the energy landscape continues to evolve, the coal industry will need to adapt and innovate to remain relevant. The use of advanced technologies, such as carbon capture and storage, could help to reduce the environmental impact of coal and make it more competitive with other energy sources. However, the high cost of these technologies and the lack of economic incentives are major barriers to their adoption. In conclusion, the global coal demand is expected to remain on a plateau in 2025 and 2026, driven by a combination of factors, including increasing competition from renewable energy sources, declining coal prices, and rising production costs. As the energy market continues to transition towards cleaner and more sustainable energy sources, the coal industry will need to undergo significant changes to remain relevant.