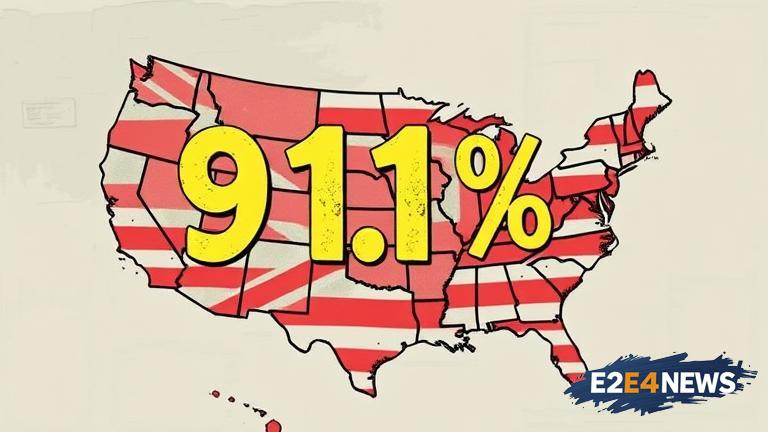

The recent surge in the US inflation rate to 9.1% has significant implications for the economy and consumers. This increase, the highest in over 40 years, is primarily driven by rising energy costs, supply chain disruptions, and a strong labor market. The inflation rate is measured by the Consumer Price Index (CPI), which tracks the average change in prices of a basket of goods and services consumed by households. The CPI has been steadily increasing over the past year, with the current rate exceeding expectations. The main contributors to this surge are energy prices, which have risen by over 40% in the past year, and food prices, which have increased by over 10%. The rising costs of housing, transportation, and healthcare have also played a significant role in the inflation rate increase. The impact of inflation on consumers is multifaceted, with higher prices affecting purchasing power and living standards. As prices rise, consumers may need to adjust their spending habits, potentially reducing demand for non-essential goods and services. The inflation rate also has significant implications for the economy, as high inflation can lead to reduced consumer spending, lower economic growth, and decreased business investment. The Federal Reserve, the central bank of the United States, has been closely monitoring the inflation rate and has taken steps to mitigate its effects, including raising interest rates. The goal of these measures is to slow down the economy and reduce inflationary pressures. However, the impact of these measures on the economy and consumers is still uncertain. Some experts argue that the current inflation rate is a result of temporary factors, such as supply chain disruptions, and that it will eventually return to normal levels. Others believe that the inflation rate is a sign of a more structural issue, such as a strong labor market and rising wages, and that it may persist for an extended period. The US government has also taken steps to address the inflation rate, including passing legislation aimed at reducing costs and increasing competition. Despite these efforts, the inflation rate remains a significant concern for policymakers, businesses, and consumers. The current inflation rate has also sparked debates about the effectiveness of monetary policy and the role of the Federal Reserve in controlling inflation. Some experts argue that the Federal Reserve has been too slow to respond to the rising inflation rate, while others believe that the central bank has taken appropriate measures to address the issue. The inflation rate has also had a significant impact on the stock market, with some investors becoming increasingly cautious about the prospects for economic growth. As the inflation rate continues to rise, it is likely that the Federal Reserve will take further action to mitigate its effects, including raising interest rates and reducing the money supply. The impact of these measures on the economy and consumers will be closely watched in the coming months. In conclusion, the US inflation rate has surged to 9.1%, marking the highest increase in over 40 years, with significant implications for the economy and consumers. The causes of this surge are complex and multifaceted, and the impact of the inflation rate will be felt across various sectors of the economy. As policymakers, businesses, and consumers navigate this challenging economic environment, it is essential to understand the underlying factors driving the inflation rate and the potential consequences of high inflation.

Wed. Nov 5th, 2025