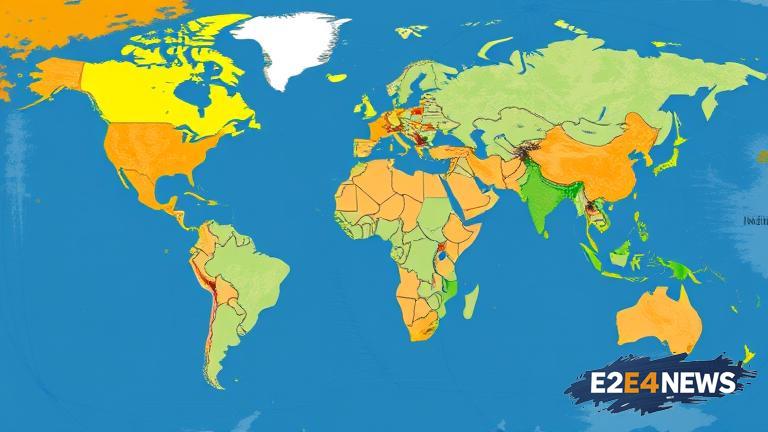

The Indian insurance industry has been undergoing a significant transformation in recent years, with a growing emphasis on term insurance. According to a recent report, term insurance adoption has been on the rise globally, and India is no exception. The life insurance penetration in India has been steadily increasing, with more people opting for term insurance policies. This shift can be attributed to increasing awareness about the importance of life insurance and changing consumer preferences. The COVID-19 pandemic has also played a significant role in driving the demand for term insurance, as people have become more aware of the need for financial protection. The Indian government has also been taking steps to promote the insurance industry, including the introduction of new policies and regulations. The Insurance Regulatory and Development Authority of India (IRDAI) has been working to increase insurance penetration and awareness, particularly in rural areas. The rise of digital platforms has also made it easier for people to purchase insurance policies, contributing to the growth of the industry. Furthermore, the increasing cost of living and rising healthcare expenses have made it essential for individuals to have a financial safety net, which term insurance provides. The report highlights that the global insurance industry is expected to continue growing, driven by emerging markets such as India. The Indian insurance industry is expected to reach $280 billion by 2025, with term insurance being a significant contributor to this growth. The industry is also witnessing a shift towards online sales, with more companies investing in digital platforms to reach a wider audience. The use of artificial intelligence and data analytics is also becoming more prevalent in the industry, enabling companies to better understand consumer behavior and provide personalized products. Additionally, the report notes that the Indian insurance industry is expected to create new job opportunities, particularly in the areas of sales and distribution. The growth of the industry is also expected to have a positive impact on the economy, contributing to the country’s GDP. However, the report also highlights the challenges faced by the industry, including low insurance penetration and a lack of awareness about insurance products. To address these challenges, the industry will need to invest in awareness campaigns and education programs, particularly in rural areas. The government will also need to continue to support the industry through policies and regulations that promote growth and development. Overall, the rise of term insurance adoption in India is a positive trend, indicating a growing awareness about the importance of life insurance and a shift towards more comprehensive financial planning. The industry is expected to continue growing, driven by emerging trends and technologies, and is likely to play an increasingly important role in the country’s economy. The report’s findings are significant, as they highlight the need for increased awareness and education about insurance products, particularly in rural areas. The industry’s growth is also expected to have a positive impact on the country’s social and economic development, contributing to the well-being of individuals and families. In conclusion, the Indian insurance industry is undergoing a significant transformation, driven by increasing awareness and changing consumer preferences. The rise of term insurance adoption is a positive trend, indicating a growing awareness about the importance of life insurance and a shift towards more comprehensive financial planning.