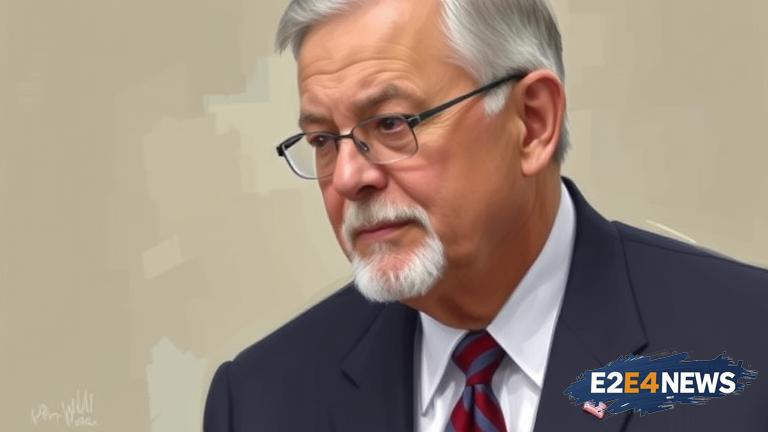

The former chairman of the Mashpee Wampanoag Tribe, a Native American tribe based in Massachusetts, has pleaded guilty to tax fraud in a federal court. The guilty plea was entered on July 26, 2025, and marks a significant development in the case. According to court documents, the former chairman, whose name has not been released, admitted to falsifying records and failing to report income to the Internal Revenue Service (IRS). The scheme, which took place over several years, involved the misuse of tribal funds for personal expenses, including luxury items and travel. The former chairman also admitted to using tribal funds to pay for personal expenses, such as mortgage payments and credit card bills. The tax fraud scheme was uncovered by federal investigators, who launched an investigation into the tribe’s financial dealings. The investigation found that the former chairman had failed to report hundreds of thousands of dollars in income, including money earned from tribal businesses and investments. The guilty plea is a significant blow to the Mashpee Wampanoag Tribe, which has been embroiled in controversy in recent years. The tribe has faced criticism over its financial dealings, including the use of tribal funds for lavish spending. The former chairman’s guilty plea is likely to lead to further scrutiny of the tribe’s financial practices. The case has also raised questions about the oversight of tribal finances and the need for greater transparency and accountability. The Mashpee Wampanoag Tribe has a long and storied history, dating back to the 17th century. The tribe has a significant presence in Massachusetts, with a large reservation in Mashpee. The tribe operates several businesses, including a casino and a hotel, which generate significant revenue. However, the tribe has faced challenges in recent years, including financial difficulties and internal power struggles. The former chairman’s guilty plea is likely to have significant implications for the tribe, including potential fines and penalties. The case is also likely to lead to further investigation into the tribe’s financial dealings, including the use of tribal funds for personal expenses. The IRS has warned that tax fraud is a serious offense, and those found guilty can face significant penalties, including fines and imprisonment. The case serves as a reminder of the importance of transparency and accountability in financial dealings, particularly in the context of tribal governments. The Mashpee Wampanoag Tribe has not commented on the guilty plea, but it is likely that the tribe will face significant scrutiny in the coming weeks and months. The case has also raised questions about the role of federal authorities in overseeing tribal finances, and the need for greater cooperation and transparency. The former chairman’s guilty plea is a significant development in the case, and it is likely that there will be further updates in the coming weeks and months. The case serves as a reminder of the importance of accountability and transparency in financial dealings, particularly in the context of tribal governments. The Mashpee Wampanoag Tribe has a long and storied history, and it is hoped that the tribe will be able to move forward from this difficult period. The case has also highlighted the need for greater awareness and education about tax fraud and financial accountability, particularly in the context of tribal governments.